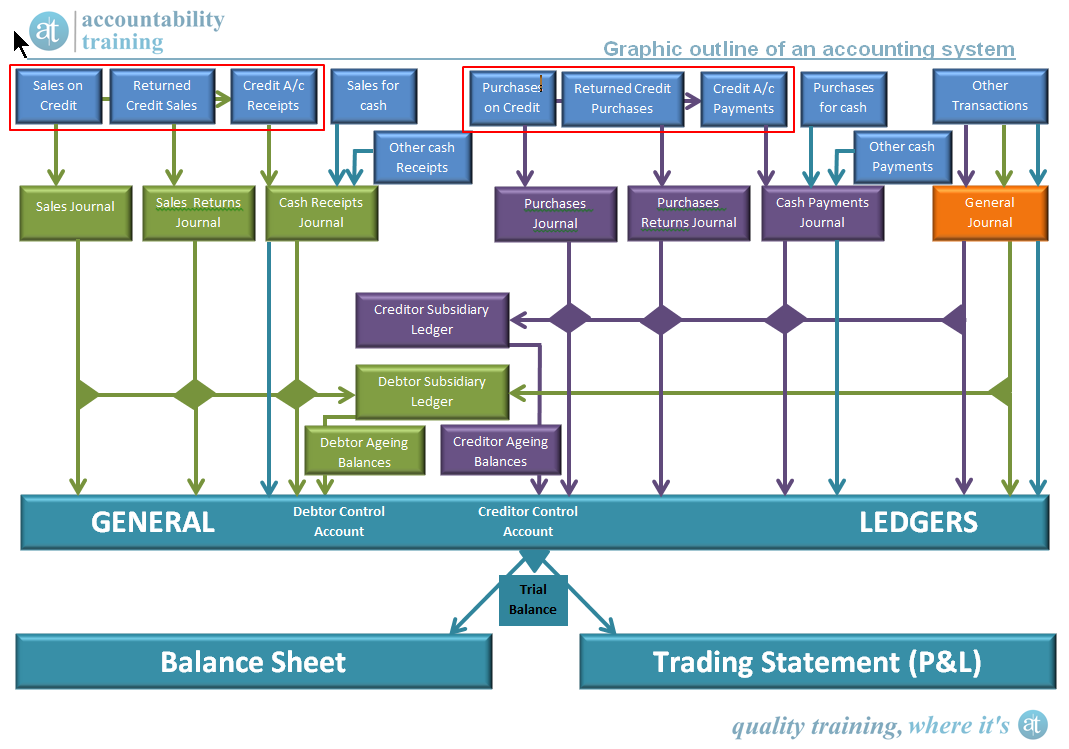

I have made a number of attempts over the years to put together a graphical outline of an accounting system. The result of these endeavours is the graphic that you see here. With it I will try and make some endeavour to explain this in a meaningful way. My ultimate aim for this is to assist both students and professional bookkeepers gain a better understanding of the processes involved. This diagram follows a manual accounting system, but if you think about this very carefully, you will also find that the electronic accounting systems available today also follow this same pattern with some variations in processes because an electronic system is unable to think and reason like you and I. Therefore an electronic system will need to do things in a slightly different way so that the net outcome of the process is still achieved. Take a few moments to study this diagram and become familiar with the links in, and the flow of information. As explanations are provided you should be able to build a very clear picture in your mind of this whole process.

Understand that accounting is an art, and not a science! This means that at times there may be more than one way to achieve the same end, but a good bookkeeper will be able to look at a transaction and see potential issues with processes further on in the process, eg. BAS, bank, asset, debtor, creditor and inventory reconciliations. A good bookkeeper can also think through a transaction and settle on a method of entry to the accounts that follows the KISS principal, by keeping entries simple to follow forwards and also backward. It is a blend between understanding the processes and data relationships together with the legal and legislative requirements imposed to produce clear and concise information that the business needs to make informed business management decisions and produce meaningful reports to all interested parties to comply with moral and legal requirements.

The Accounting System Outline

The basic format

An accounting system records business transactions that occur on a day by day basis, and these transactions either occur as a cash or a credit transaction. This means we will either sell goods and services for immediate cash receipt, (Cash) or for delayed cash receipt, (Credit). Likewise we will purchase goods or services on the same basis, an immediate cash payment, (Cash) or for delayed cash payment, (Credit).

It will be noted that the left side of the above graphic starts off with credit sales, credit sales returns and cash received for payment receipt of these credit accounts. These credit sales transactions are grouped inside the red rectangle and will feed down to the sales journal, sales returns Journal and cash receipts Journal. These will then feed through to the general ledger accounts directly and also to the debtor subsidiary ledger. These then flow through the debtor ageing balances to confirm balances posted directly to the general ledger. Sales for cash and other cash receipts are also fed onto the cash receipts journal and then directly through to the general ledger.

From the centre of the graphic into the right we have the credit purchases, credit purchases returns and cash paid to pay off these credit accounts. These credit purchase transactions are grouped inside the red rectangle and will feed down to the purchases journal, purchases returns journal and cash payments journal. These will then feed through to the general ledger accounts directly and also to the creditor subsidiary ledger. These then flow through the creditor ageing balances to confirm the balances posted directly to the general ledger. Purchases for cash and other cash payments are also fed into the cash receipts journal and then directly through to the general ledger.

On the far right we find that any transaction that cannot be processed through one of the credit journals or the cash journals are processed using the general journal. These general journals may feed to the creditor or debtor subsidiary ledgers and / or directly through to the general ledger accounts depending on what the transaction actually is.

Once the general ledger has been completed and checked with the use of the trial balance, the closing balances for each of the general ledger accounts are placed into the appropriate place for either the balance sheet or the trading statement, (P&L).

This is a basic introduction to accounting. A manual accounting course is currently being developed to assist bookkeepers understand the accounting processes much better than is the case currently in many instances. This course will be published to this web site complete with video training tutorials, learning guides, practical activities and challenge activities for a small fee in an effort to cover the months of development costs.

I would be interested in your comments.

Rob