A business often has a need to borrow money from financiers for a variety of reasons, which could include short term bridging finance, purchase of assets or business expansion. Purchase of business assets can be made through a variety of options. The most common of these would be Chattel Mortgage, Hire Purchase and lease. Remember that we as bookkeepers are not in a position to advise a client which option they should choose for tax purposes

What I want to do today is provide a basic introduction to the purchase of a motor vehicle that comes under the Luxury Car Tax requirements. With this in mind we first need to present information from wich the resulting transactions will be taken. The year purchase date will be 1st September 2014. The purchase details are shown in the tables below. The LCT limit for 2014 year is set at $60,316.

Purchase Details

| Total cost of the Land Cruiser | $81,500.00 |

| Registration Cost | $542.00 |

| Compulsory Third Party Insurance | $446.60 |

| Stamp Duty | $2,852.50 |

| Total Purchase Price | $85,341.10 |

| LESS - Trade-in Vehicle - Inc GST | $8,000.00 |

| Total Payable to Dealer | $77,341.10 |

Finance Details

| Amount Payable to the Dealer | $77,341.10 |

| Loan Establishment Fee | $390.00 |

| Loan Registration Fee | $12.00 |

| Stamp Duty | $141.22 |

| Loan Total | $77,884.32 |

| Term Interest | $10,754.88 |

| Loan Repayment Total | $88,639.20 |

Repayment Details

| Residual Value after 4 years | $10,000.00 |

| 48 Monthly Repayments |

MYOB Transaction - Purchase

Some people have a preference to enter this type of transaction through the use of a general journal rather than through spend money, I have no issue with that approach.

The entry into MYOB needs to be given careful consideration to insure the integrity of the entry is maintained and the ability to reconcile GST is also maintained as there is a trap here for the unwary.

The vehicle cost is $81,500, and the LCT limit for the 2014 year is $60,316 which means that the business can claim the GST back on this value only. The balance is then entered with a capital aquisition, tax free GST code. Both of these codes will be reported at G10 on the BAS statement.

The vehicle registration is entered in it's two elements, that which is GST Free and that which is GST applicable.

The next element shown here is the stamp duty on the vehicle as well as the registration of the vehicle. It is worth noting here that as this example is the purchase of a new vehicle in Queensland the current duty calculation tools combine the duty on both. I did not explore other states, and nor did I explore the duty arrangements on second hand vehicles, so there could be a document that provides a value in duty for the vehicle and another for the registration. With no easy way to separate these, this example posts all vehicle purchase and registration duties to the purchase of the motor vehicle as almost all of the duty would be attributed to the vehicle purchase anyway.

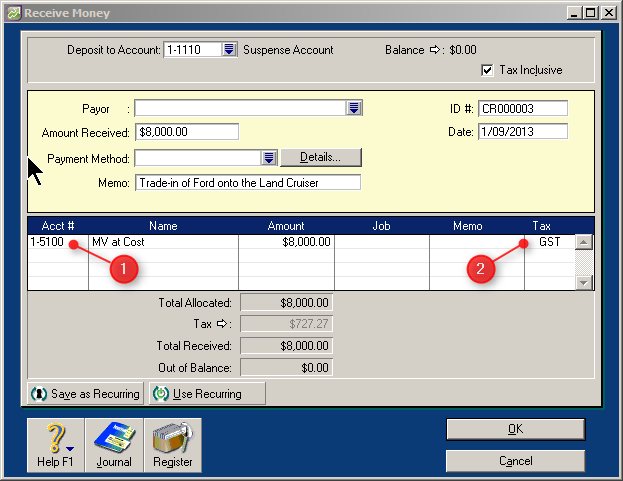

The next element is the trade-in of the old motor vehicle which is a receive money transaction. As a receive money transaction entered through a spend money transaction there is an inevitable conflict that arises. If you are thinking that the general journal entry method would not have any conflict, then you need to review what exactly is going to happen as the entry is made. GST on a receive money transaction will be entered to GST Collected and as such a reconciliation between the sale value and the GST collected. Likewise when a spend money transaction is used, the GST ends up in GST Paid. It now becomes apparent that the conflict that will exist is that if we allocated the trade-in directly to Motor Vehicles at cost, a collectable not payable value, the GST collected would simply offset the GST paid on the actual spend money items. The result being that a reconciliation between the purchase values and the GST Paid, as well as the sale value and the GST Collected cannot be achieved.

There are two solutions to this problem, both of which are acceptable.

The first solution is to process this trade-in through a suspense / clearing account as has been done in the example above. This has the benefit that will place the collected GST on the correct side of the ledger and be shown on the reports the same way as any other GST collected sale item. Reports are correct showing the GST on the correct side of the ledger, and when completing the GST reconciliation, values on the other side of the report, what is shown as collected is collected, and what is shown as paid is paid.

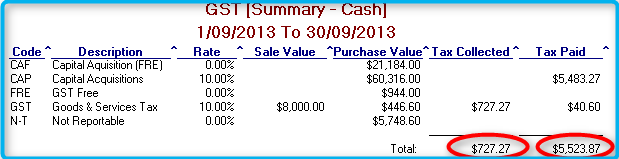

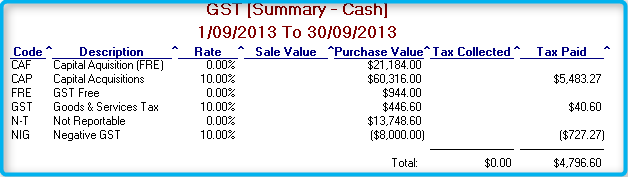

Above is the GST summary cash report that will generate from this transaction. It can be noted that the GST Paid shown on the report is the same as that shown on the spend money transaction above.

It can also be noted that the GST Collected on this report is the same as that shown on the receive money transaction

The Second Solution

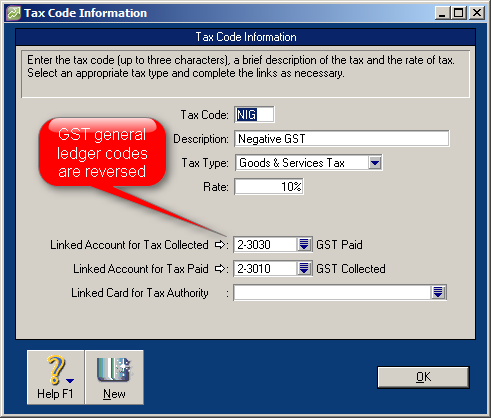

The second solution requires the creation of a negative tax code that is set to place the GST Collected on the paid side and the GST Paid on the collected side. The downside of this approach is that while the GST is placed on the correct side in the accounts, it will still be shown on the GST paid side as a negative value in the GST report.

The first step would be to create the negative tax code to use on the transaction.

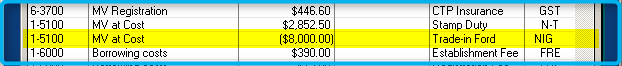

The next step would be to change the line entry in the spend money transaction above to the one shown below. Because the transaction is now being processed, there would then be no need for the receive money transaction shown above, so that can be deleted.

The GST Report would look like the one above. It can be noted that the sale item is shown on the purchases side of the report as a negative value and Tax collected is shown on the the paid side still, but as a negative value. When completing the GST reconciliation the negative value shown on the report is in fact GST Collected and all related values will be sales and tax collected. These things need to be properly understood when reconciling GST.

Because I believe that a bookkeeper should always look at any processes used to minimise the possibility of errors occuring, my personal belief is that the first option is the preferable option.

Happy to receive any comments you may have in relation to this blog entry, and love to have forum comments created to discuss it, as this can only be to the benefit of everyone.