This weeks' discussion will look at at the monthly repayment of the loan account that was created and entered in last week's blog post. This discussion will look at the three components that will make up this monthly payment.

- The loan repayment component

- The interest component

- The borrowing cost component

The Repayment Component

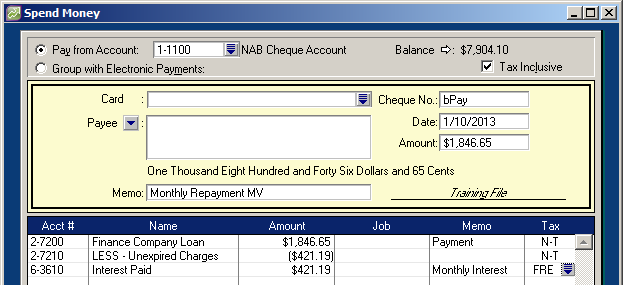

This will begin with a review of the value of the principal, $77,884.32, the term interest, $10,754.88 which provides the total value to be repaid, $88,639.20 assuming the loan runs it's full term. This value will be repaid over 48 equal monthly payments of $1,846.65 per month. The first component of this payment will be entered into MYOB as follows:-

The interest Component

The interest can be calculated two ways, providing two different outcomes. The method chosen will be dependant on the goals of the business in terms of available tax deductions that will affect the taxable income of the business. The overall tax deductability will be exactly the same over the life of the loan, the difference lies only in the timing and value of the interest claims.

Amortisation Table Method

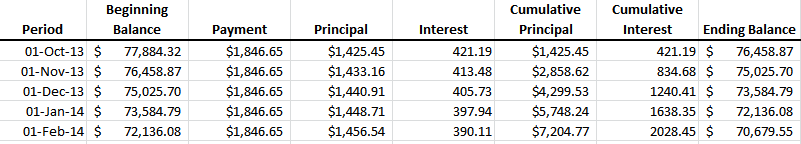

The amortisation table method provides a constantly changing and steadily declining interest claim each month based on the remaining principal component still due. (See the table below)

Advantages

- Higher interest available to be claimed in the first half of the loan term

- Tracking of the progressive principal and interest paid on the loan each month

- More accurate overall interest claim if the loan does not run its full term

Disadvantages

- Lower interest available to be claimed in the second half of the term of the loan

- Varying interest payment does not lend itself to the creation of a monthly recurring transaction

- Higher likelihood of an error being made in the monthly payment transaction

Evenly Distributed Method

The evenly distributed interest method simply takes the interest component for the term of the loan, $10,754.88, and divide it by the number of payments in the term, 48, which provides a evenly distributed interest component of $224.06 per month

Advantages

- Consistant monthly interest claim over the term of the loan

- Better lends itself to the creation of recurring entries

- Lowers the probability of errors due to varying interest values

Disadvantages

- Variations between actual interest and claimed interest each month

- Interest and principal payments are not tracked monthly

- Inaccurate interest value claimed if the loan does not run it's full term

In this example, the amortisation table has been used, and this component is added to the payment component of the transaction.

The Borrowing Cost Component

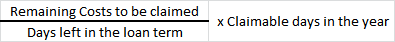

Under the ATO rules, borrowing costs cannot be claimed at the time of the loan creation, but rather are claimed over the life of the loan. In this instance the borrowing costs on this loan amounted to $543.22. The ATO calculation for claiming these costs each year follows the following formula:

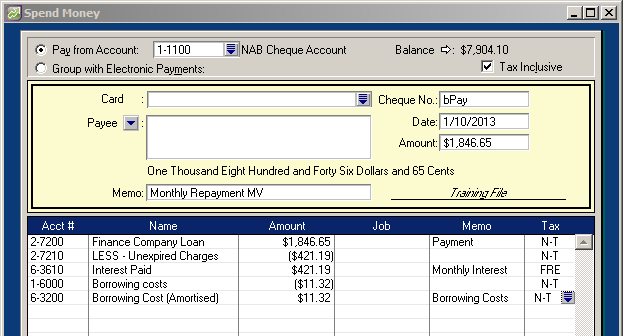

This formula amounts to the same as total borrowing costs, $543.22, divided by the months in the term, 48, which will give a claimable value of $11.32 per month. This borrowing cost component is then added to the monthly payment transaction which is now complete.

The only thing that remains is to record the transaction.

I trust this adds to the overall understanding of these entries.